A Value at Risk Framework for Advertising Revenue

- 2 days ago

- 2 min read

Advertising is often treated as a forecasting problem: estimating how much revenue a campaign will generate. In reality, advertising is a risk allocation problem. The same budget deployed on the same platform can produce materially different outcomes. Treating advertising as deterministic creates fragile planning and reactive decision-making.

This document presents a Value at Risk (VaR) framework adapted from financial risk management, designed to model advertising investment in terms of probabilistic revenue outcomes rather than point forecasts.

Why the Platform Matters

In a revenue-based VaR model, platforms matter because each platform produces its own distribution of viewership for a given level of spend. Auction dynamics, algorithmic amplification, inventory constraints, and saturation effects cause identical budgets to result in different delivery ranges across platforms.

Viewership as the Core Random Variable

Viewership is treated as the primary stochastic variable in the model. For a given budget, platform, and targeting configuration, viewership is represented as:

Historical data is used to estimate platform-specific distributions of viewership outcomes, capturing conservative, median, and favourable delivery scenarios.

Translating Viewership into Revenue

Once viewership is realised, revenue is generated mechanically through known or estimated funnel parameters, including click-through rates, conversion rates, average transaction values, and customer value multipliers.

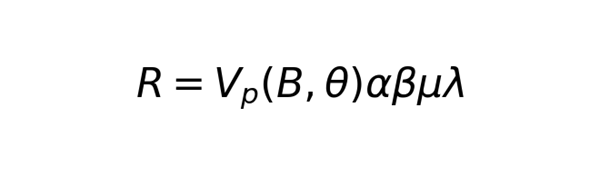

Revenue is defined as:

Revenue Distribution and Value at Risk

Because revenue is a monotonic transformation of viewership, the revenue distribution is derived directly from the viewership distribution.

The revenue quantile at confidence level q is defined as:

Revenue Value at Risk is then defined as:

VaR represents the lower bound of revenue outcomes at a chosen confidence level. For example, a 95% VaR indicates the minimum revenue expected in 95% of comparable scenarios.

Expected Revenue and Reporting Ranges

Expected revenue is given by:

In practice, revenue is reported as a range bounded by lower and upper quantiles, allowing decision-makers to explicitly assess downside risk and upside potential.

Using VaR for Platform Selection and Budget Allocation

Because platform-specific delivery uncertainty is captured explicitly, VaR enables direct comparison of platforms based on revenue risk rather than anecdotal performance. Budgets can be allocated as a portfolio, balancing stable platforms with higher-variance growth channels.

Assumptions and Limitations

The model assumes reasonably stable platform delivery behaviour, independence between viewership and funnel parameters, and the continued relevance of historical data. When these assumptions weaken, recalibration is required.

Conclusion

Advertising is inherently uncertain. A Value at Risk framework replaces false certainty with disciplined probabilistic thinking. The goal is not to eliminate risk, but to understand and price uncertainty before committing capital.

Comments